Growth Teams Part 2

In the last post, we covered the following:

- The origins of growth teams

- How typical growth teams are structured

- The first set of actions a nascent growth team should do, especially if the charter is ambiguous

You can read the first post here.

We chose to accept an ambiguous growth team charter at Automox because we believed the company was ambitious and thought the people had the right mindset to collaborate with (e.g. high humility and high curiosity).

In this post, we’ll talk about how to quickly understand a business and establish conviction around where a nascent growth team has the highest leverage.

Creating a mental model in a new context

Understanding a new business requires a lot of listening and data mining.

Immediately, we began interviewing and building relationships with many people across the company, focusing in a few key areas:

- Executive leadership to identify consistency of vision and strategy, and perception of constraints

- Sales leaders to understand the value proposition that resonated with the market and the reality of what friction existed on the ground

- Engineering and product leaders to get a sense of how R&D aligned with S&M, the core technology bets that might realize the mid-term opportunity, and to gather empathy for the customer problem

- Operations stakeholders, including in sales and marketing ops to understand whether the systems and processes supported the execution bets the company was making

Regardless of how folks perceived Automox’s growth, we also needed to internalize objectively how the company grew, how it wanted to grow in the future, and the constraints that prevented it from doing so at that time.

This was a combination of the following:

- Gathering data and context from sales, marketing, and finance to understand how the business is currently segmented and current assumptions about growth

- Visualizing acquisition, retention, and segmentation to observe current business trends and processes

- Lining up observed growth with assumptions baked into operating model

Interviewing internal stakeholders

To ensure we were gathering well-rounded opinions we focused on several, consistent questions:

- What is the company trying to prove within the next 12 months?

- What are the most important opportunities you think we’re not exploiting fast enough?

- What are the most important risks that you think we’re not mitigating fast enough?

- Why do you think the company wants to build a growth function?

- If a growth team is wildly successful, what do you think it will have accomplished in the next 12 months?

We took detailed notes in every conversation, and then simply entered summarized answers in a spreadsheet.

Understanding business mechanics

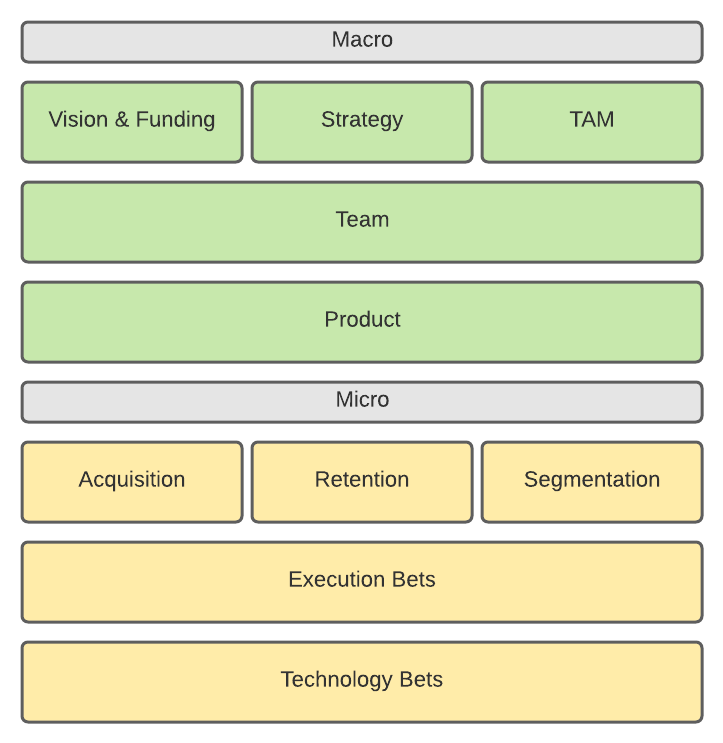

We chose to separate our mental model of the business into macro and micro factors. With this framework, we could quickly articulate the business’ context in logical categories, and ask the right questions of others to fill in gaps that we couldn’t answer with documents we already had access to.

We focused on macro factors that helped us answer questions related to the size of the opportunity and whether the product, strategy & vision, and team were positioned well to realize it. Those factors included:

- Vision & Funding - What did stakeholders in the business want to reach for?

- Strategy - What was the strategy to reach their vision?

- TAM - What was the accepted size of the market? Did it support the continued growth of the business?

- Team - Was the team inexperienced? Had they done this type of thing before? What did they excel at?

- Product - Where was the product currently? Who had it resonated with?

We focused on micro factors that dove deeper into how customers reacted to the business evidenced by how they bought and their longevity with the product, and how our planned tactics would support them in the future.

- Acquisition - How did customers traditionally buy from the business? In what configuration (ASP, packages)?

- Retention - How long did customers stick around? Did that result in net contraction or expansion over time?

- Segmentation - How did the business think about selling to the customer base?

- Execution Bets - What GTM investments did the business think were necessary to support future growth?

- Technology Bets - What R&D investments did the business think were necessary to support future growth?

You can find a template of this framework here.

Building Conviction & Communicating with the Executive Team

Once we could articulate the current context well through qualitative and quantitative inputs, we synthesized all of that information into a format that was easy to understand and collaborate on with others – that’s where Minto came in.

The artifact looked like this:

- Situation - the unambiguous facts of the business, driven by a summary of the macro and micro factors of the business.

- Complication - obvious friction or dissonance that is making it harder, or will make it harder, for the company to achieve its growth goals.

- Question - how can we remove the constraints?

- Answer - suggested methods to remove those constraints, supported by logical arguments and backed by evidence.

The above work effectively established two outputs:

- A solid understanding of the macro and micro business mechanics, and a clear mental model for addressing the primary constraints on growth rate

- Conviction about where the growth team’s resources could best be focused

This second piece allowed us to evaluate common definitions of growth and select the definition that was most applicable to the company’s unique strategic needs.

In our case, several constraints existed across the business that were primarily oriented around execution bets.

The company needed to grow revenue materially in the succeeding 18 months, and a consistent data layer to visualize product usage data and GTM data was the the critical foundation to do so. That layer would empower our team and the rest of the organization to measure themselves and the business more consistently and much faster.

We were able to ship that first deliverable within a month, which ended up being high leverage for the organization. That has led to our ability to baseline components of the business and begin addressing the other constraints identified in the exercise above.

In future posts, we’ll explore:

- Balancing mission-oriented and persistent ownership while tackling growth constraints

- Building a roadmap for product-led growth

- Building a growth process & discipline around it

- Productizing the growth function